5-7

¶ 1 Leave a comment on paragraph 1 0 Maximilian von Pappenheim continued to collect various taxes from his Jewish subjects and pro forma serfs until his death on February 14, 1639. His first son, Ernst Friedrich, had died in infancy. His second son, Heinrich Ludwig, was killed in the Thirty Years’ War during the siege of Castle Hohenstoffeln by a shot to the head in 1633. His daughter, Maximiliane Maria, died as the young wife of Count Friedrich Rudolf von Fürstenberg in 1635; the widower thus inherited the title to Stühlingen town and county on behalf of their young son.

¶ 2 Leave a comment on paragraph 2 0 Protection and tax demands continued under Fürstenberg’s rule, but no new letters of protection were issued for the next fifty-four years.

¶ 3

Leave a comment on paragraph 3 0

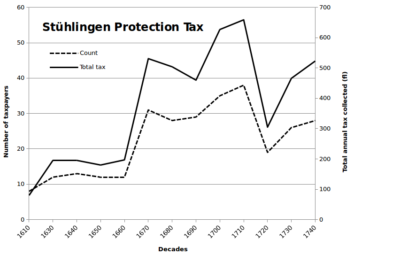

Figure 6. Number of Jewish households and annual taxes collected per decade.

Figure 6. Number of Jewish households and annual taxes collected per decade.

¶ 4 Leave a comment on paragraph 4 0 The data for the diagram in figure 6 has been collated from the various municipal and county records. Since the archival holdings are incomplete, taking averages would have underestimated the actual taxes paid; instead, we have chosen the maximum annual value in each decade. It thus appears that the taxed Jewish population of Stühlingen was relatively stable until the 1660s. It then rose rapidly over the next ten years, partly due to coming of age of the third generation, and partly due to immigration, possibly as an after-effect of the Thirty Years’ War. The majority of new taxpayers settled in the surrounding villages, but were taxed by the counts of Fürstenberg, and administered through Stühlingen. Their number exceeded by far the original number of contractual slots. The gentile population of Stühlingen objected vigorously, and in 1671 a new letter of protection was issued that attempted to stem the growth. This letter set the number of protected Jewish households at thirteen plus, at most, one married child, that is, a total of twenty-six households, as well as a cantor and a beadle (Schulklopfer). No allowance was made for a rabbi. For the new letter of protection to be issued, the Jews had to make a one-time payment of 500 fl., and in addition the Jews had to assume a debt of 500 fl. to the count. The annual protection tax was raised to 18 fl. plus a plump goose per household.21 Although the number of Jews stabilized, popular complaints persisted [R1281].

21Häusler, Stühlingen: Vergangenheit und Gegenwart, 155.

Comments

0 Comments on the whole Page

Login to leave a comment on the whole Page

0 Comments on paragraph 1

Login to leave a comment on paragraph 1

0 Comments on paragraph 2

Login to leave a comment on paragraph 2

0 Comments on paragraph 3

Login to leave a comment on paragraph 3

0 Comments on paragraph 4

Login to leave a comment on paragraph 4

0 Comments on paragraph 5

Login to leave a comment on paragraph 5